I have observed firsthand the transformative impact of venture capital on communities, especially when it nurtures a diversity of individuals to become both entrepreneurs and investors. The essence of venture capital goes beyond mere financial transactions; it’s about fostering an ecosystem where voices contribute to and benefit from economic prosperity.

The Diversity Deficit in Venture Capital

Historically, the venture capital industry has been critiqued for its lack of diversity. A narrow focus on certain demographics has not only limited the scope of innovation but also the potential for creating broad-based wealth. This has resulted in missed opportunities, both in terms of business growth and societal impact. I often wonder if leaders in venture capital, ask themselves the real question: Are we truly tapping into the full spectrum of entrepreneurial talent?

Creating Pathways for Inclusive Wealth

Wealth creation in venture capital should be as diverse as the society we live in. This means actively investing in and supporting entrepreneurial talent from underrepresented groups, including the LGBTQ+ community, people of color, women, and others who have historically been sidelined in the financial narrative. The Pride Fund is committed to level the playing field, ensuring that these entrepreneurs not only have a seat at the table but also the resources to thrive.

The Ripple Effect of Inclusive Investment

When diverse individuals become successful entrepreneurs and investors, the benefits extend far beyond their individual success. They become role models, mentors, and leaders within their communities, inspiring others to follow in their footsteps. This creates a virtuous cycle of empowerment and opportunity, leading to a more robust and resilient economy.

Championing Diversity in Venture Capital

Our mission at the Pride Fund is not just about providing capital to LGBTQ+ led startups; it’s about championing the cause of diversity in the venture capital ecosystem. We believe that by creating more inclusive investment practices, we can uncover innovative solutions to some of society’s most pressing challenges. Diversity in thought and experience leads to more creative problem-solving, ultimately resulting in higher-performing companies and stronger economic growth.

Call to Action

To my fellow investors, entrepreneurs, and industry leaders: the time to act is now. We must commit to creating pathways for inclusive wealth, not as a charitable endeavor, but as a strategic imperative. Let us work together to build a venture capital landscape that mirrors the diversity of our world, where everyone has the opportunity to succeed and contribute to our collective prosperity.

The role of venture capital should be to catalyze not just financial wealth, but a wealth of opportunities for all. By fostering a diverse and inclusive entrepreneurial ecosystem, we can drive forward not only business innovation but also societal progress.

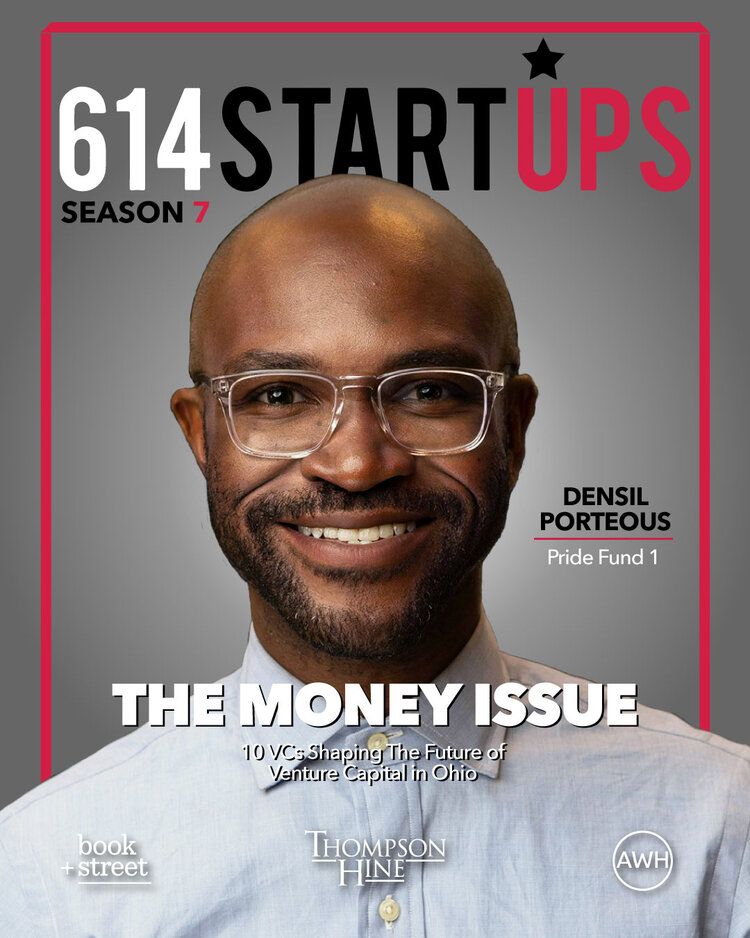

Arlan Hamilton, Densil Porteous, and Ben Stokes reflect a handful of LGBTQ+ venture fund leaders who are Black and queer.